Press releases

Buffalo thunders back as Zillow's hottest market for 2025

Jan 7, 2025

Affordability and job growth are key drivers of competition

- Competition among buyers never cooled in Buffalo last year, and that heat should keep smoldering through 2025.

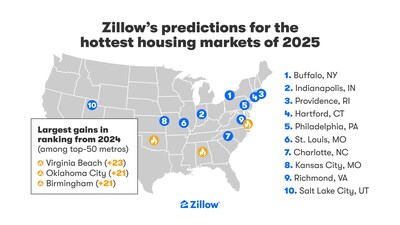

- Hot markets spread from the Northeast, Great Lakes and South regions into the Midwest and West.

- Virginia Beach jumped farthest up the list from 2024, leapfrogging over 23 markets.

SEATTLE, Jan. 7, 2025 /PRNewswire/ -- Buffalo, New York, will be the hottest major housing market in 2025, according to a new analysis by Zillow®, the first time a market has held the title in back-to-back years. Relative affordability and few homes for sale are common threads among what should be the most competitive markets for buyers this year.

"Construction that keeps pace with an area's growth remains a crucial piece of keeping homes available and accessible. In chilly Buffalo, competition among buyers will remain hot, with employment growing far faster than builders are adding homes," said Skylar Olsen, Zillow chief economist. "Shoppers nationwide should see more options for sale than in recent years, along with slow and steady price growth. That's the good news. But both buyers and sellers should expect unpredictable mortgage rates."

This hotness ranking of the nation's 50 most populous metros takes into account Zillow's forecast for local home value growth and how quickly homes are selling. It also considers job growth per new home permitted and expected growth in owner-occupied households.

Zillow forecast Buffalo to be the hottest market in 2024, and that prediction proved prescient. Sellers held a strong advantage in negotiations there throughout last year, according to Zillow's market heat index.

Buffalo has the most new jobs per new home permitted — a measure of expected demand. New jobs often mean new residents, which raises competition and drives up prices unless builders can match the additional demand.

Although affordability has improved slightly compared to last year, it's still top of mind for buyers. Lower-than-average home prices and rent costs in Buffalo as well as Midwest metros like Indianapolis, St. Louis and Kansas City have bolstered demand in these areas, helping push them to the top of the list.

Relative affordability is a powerful force, too. Nearby alternatives to expensive Northeastern metros like New York and Boston dominated Zillow's list of the most popular cities among home shoppers in 2024. Metropolitan areas in the same vein — Providence, Hartford and Philadelphia — rank high on this list as well.

Hartford, Providence, Indianapolis and Charlotte are all among the top five in Zillow's forecast for home value appreciation in 2025. Hartford leads the pack with 4.2% expected growth. But home value growth is set to largely level out this year — even these standout metros look tame compared to the double-digit annual appreciation seen in 2021 and 2022.

Rising fastest in the ranks from 2024's hottest markets list is Virginia Beach, which leapfrogged over 23 markets to the No. 13 spot this year, driven by job growth that has far outpaced new home permitting. Memphis fell the farthest by the same token, dropping 30 places, as new home permitting has eclipsed low job growth.

After the entire western half of the country was shut out of last year's top 10, Salt Lake City nudged its way onto this year's list at No. 10. San Diego was the only other Western metro in the top 20, at No. 19.

Mortgage rates are likely to continue on their bumpy path in 2025, and swings will have a major impact on which homes shoppers can afford or even qualify for. Zillow Home Loans' BuyAbilitySM tool tracks rates in real time to show users which homes fit their budget.

|

2025 |

Metropolitan |

Change |

Zillow |

ZHVI |

2025 |

Jobs per |

Change in |

|

1 |

Buffalo, NY |

0 |

$260,537 |

5.7 % |

2.8 % |

2.0 |

-46.1 % |

|

2 |

Indianapolis, IN |

2 |

$275,639 |

3.6 % |

3.4 % |

0.5 |

-16.1 % |

|

3 |

Providence, RI |

2 |

$484,019 |

6.7 % |

3.7 % |

1.3 |

-62 % |

|

4 |

Hartford, CT |

15 |

$363,298 |

6.5 % |

4.2 % |

1.1 |

-68.6 % |

|

5 |

Philadelphia, PA |

6 |

$362,744 |

4.6 % |

2.6 % |

1.5 |

-46 % |

|

6 |

St. Louis, MO |

9 |

$250,141 |

4.2 % |

1.9 % |

1.3 |

-43.8 % |

|

7 |

Charlotte, NC |

0 |

$377,450 |

1.6 % |

3.2 % |

-0.5 |

17.5 % |

|

8 |

Kansas City, MO |

10 |

$299,118 |

3.8 % |

2.7 % |

0.2 |

-36 % |

|

9 |

Richmond, VA |

11 |

$368,957 |

4.1 % |

2.9 % |

-0.1 |

-43.3 % |

|

10 |

Salt Lake City, UT |

18 |

$543,324 |

2.8 % |

2.3 % |

0.5 |

-4.8 % |

|

11 |

Cincinnati, OH |

-9 |

$281,887 |

4.6 % |

2.9 % |

-0.2 |

-32.8 % |

|

12 |

Columbus, OH |

-9 |

$310,746 |

3.8 % |

3.1 % |

-0.8 |

-20.5 % |

|

13 |

Virginia Beach, VA |

23 |

$349,186 |

4.6 % |

2.5 % |

1.2 |

-42.6 % |

|

14 |

Cleveland, OH |

-6 |

$228,140 |

6.4 % |

2.8 % |

0.6 |

-52.6 % |

|

15 |

Miami, FL |

10 |

$486,056 |

1.0 % |

3.5 % |

1.0 |

-4.4 % |

|

16 |

Boston, MA |

10 |

$694,494 |

4.7 % |

2.1 % |

0.1 |

-45.8 % |

|

17 |

Oklahoma City, OK |

21 |

$230,466 |

2.5 % |

2.4 % |

0.7 |

-2.5 % |

|

18 |

Detroit, MI |

6 |

$248,126 |

4.8 % |

1.7 % |

0.1 |

-34.1 % |

|

19 |

San Diego, CA |

10 |

$939,174 |

3.8 % |

2.5 % |

-0.4 |

-32.9 % |

|

20 |

Birmingham, AL |

21 |

$247,509 |

0.7 % |

1.3 % |

0.4 |

-13.9 % |

|

21 |

Raleigh, NC |

-4 |

$441,066 |

1.1 % |

1.7 % |

-0.7 |

-13.5 % |

|

22 |

Riverside, CA |

12 |

$583,420 |

3 % |

2.4 % |

-0.3 |

-25. % |

|

23 |

Orlando, FL |

-14 |

$391,924 |

-0.3 % |

2.2 % |

-0.6 |

17 % |

|

24 |

Atlanta, GA |

-18 |

$379,262 |

0.3 % |

2.6 % |

-0.7 |

-3 % |

|

25 |

Pittsburgh, PA |

-9 |

$208,583 |

2.8 % |

0.6 % |

1.0 |

-32.3 % |

|

26 |

Louisville, KY |

-12 |

$255,206 |

4.7 % |

1.9 % |

-0.4 |

-27.1 % |

|

27 |

Phoenix, AZ |

8 |

$454,001 |

-0.3 % |

1.7 % |

-0.4 |

-7.9 % |

|

28 |

Washington, DC |

11 |

$567,825 |

4.4 % |

0.8 % |

-0.1 |

-38.8 % |

|

29 |

Tampa, FL |

-19 |

$372,170 |

-2.5 % |

2.2 % |

-0.6 |

7.3 % |

|

30 |

Dallas, TX |

-9 |

$368,683 |

-0.4 % |

1.0 % |

-0.4 |

1.5 % |

|

31 |

Nashville, TN |

2 |

$436,301 |

1.7 % |

2.2 % |

-0.8 |

-10.8 % |

|

32 |

Seattle, WA |

0 |

$735,683 |

5.1 % |

1.9 % |

-1.0 |

-23.5 % |

|

33 |

Baltimore, MD |

10 |

$386,001 |

3.6 % |

0.8 % |

-0.2 |

-46.9 % |

|

34 |

Los Angeles, CA |

-11 |

$949,057 |

4.6 % |

1.7 % |

-0.4 |

-26.1 % |

|

35 |

Las Vegas, NV |

-23 |

$428,725 |

5.1 % |

1.1 % |

0.2 |

-18.3 % |

|

36 |

San Antonio, TX |

13 |

$280,603 |

-1.8 % |

0.3 % |

0.2 |

22.7 % |

|

37 |

Sacramento, CA |

-10 |

$577,630 |

2.1 % |

0.0 % |

0.0 |

-29.9 % |

|

38 |

Houston, TX |

9 |

$306,191 |

0.6 % |

0.6 % |

-0.3 |

1 % |

|

39 |

Chicago, IL |

-17 |

$321,484 |

5.4 % |

1.2 % |

-0.5 |

-48.6 % |

|

40 |

Jacksonville, FL |

-9 |

$353,501 |

-0.9 % |

1.9 % |

-0.8 |

14.1 % |

|

41 |

New York, NY |

4 |

$677,368 |

6.4 % |

1.3 % |

0.3 |

-55.9 % |

|

42 |

Milwaukee, WI |

2 |

$343,920 |

5.3 % |

2.4 % |

-1.6 |

-27.1 % |

|

43 |

Memphis, TN |

-30 |

$233,885 |

1.1 % |

2.3 % |

-1.7 |

-1.2 % |

|

44 |

Denver, CO |

4 |

$579,604 |

0.8 % |

0.1 % |

-0.6 |

4.3 % |

|

45 |

Minneapolis, MN |

1 |

$368,562 |

2.5 % |

0.2 % |

-0.8 |

-26.7 % |

|

46 |

Austin, TX |

-6 |

$444,248 |

-3.2 % |

-0.4 % |

-0.6 |

33.7 % |

|

47 |

Portland, OR |

-10 |

$543,814 |

1.8 % |

0.3 % |

-1.3 |

-19.3 % |

|

48 |

San Jose, CA |

-6 |

$1,588,186 |

7.9 % |

-0.2 % |

-1.3 |

-34.8 % |

|

49 |

San Francisco, CA |

-19 |

$1,140,718 |

2.7 % |

-1.7 % |

-1.1 |

-3.5 % |

|

50 |

New Orleans, LA |

0 |

$235,657 |

-1.4 % |

-3.8 % |

-0.9 |

61.1 % |

About Zillow Group:

Zillow Group, Inc. (Nasdaq: Z and ZG) is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, dedicated partners and agents, and easier buying, selling, financing, and renting experiences.

Zillow Group's affiliates, subsidiaries and brands include Zillow®, Premier Agent®, Zillow Home Loans℠, Zillow Rentals®, Trulia®, Out East®, StreetEasy®, HotPads®, ShowingTime+℠, Spruce®, and Follow Up Boss®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2025 MFTB Holdco, Inc., a Zillow affiliate.

(ZFIN)

SOURCE Zillow

For further information: Mark Stayton, Zillow, press@zillow.com