Press releases

Relaxed mortgage rates mean serious savings for buyers

Jan 16, 2024

Rate lock is losing its grip on homeowners

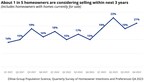

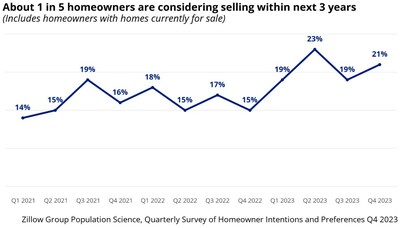

- Twenty-one percent of homeowners surveyed by Zillow are considering selling, up from 15% one year ago.

- Monthly mortgage payments, down $143 from October peaks, are (technically) affordable again.

- Recovering inventory levels are far below pre-pandemic norms, and competition for listings is still stiff.

SEATTLE, Jan. 16, 2024 /PRNewswire/ -- Buyers are getting some much-needed relief, and more homeowners appear to be breaking free of "rate lock," according to the latest monthly report1 from Zillow®. Yet despite improvements in inventory, competition for homes is still relatively stiff.

"Buyers found significant savings as rates fell. But mortgage rates are fickle things, as we've seen in recent weeks, and they'll play a massive role in determining appreciation and affordability — especially for first-time buyers — going forward in 2024," said Skylar Olsen, Zillow chief economist. "Fortunately, rate lock appears to be wearing off for some homeowners, who show encouraging signs that they're ready to come back to the market."

A recent Zillow survey of homeowners found that 21% are considering selling their home within the next three years. That's up from 15% a year ago.

The survey, fielded in Q4 of 2023, also found that the share of homeowners considering selling was almost the same whether they had a mortgage rate above or below 5%.

That's a big change from six months ago, when homeowners with rates above 5% were nearly twice as likely to consider selling.

The survey data shows that more owners with low rates are warming up to the idea of selling, while those with higher rates probably purchased their house fairly recently. Current mortgage rates look to be less of a determining factor when considering a sale.

A home purchase becomes affordable* again

Monthly payments for a new mortgage on a typical home are now $1,790 — that's $143 less than in October. The drop has brought affordability back to home buying — by some definitions. For the first time since April, a new mortgage at 20% down now takes less than 33% of the median household income2. But that's a national average. Prices are so high that the median household can't even qualify for a mortgage in many expensive metros. A 20% down payment is a high bar, too, especially for first-time buyers. Half of all buyers put less money down, and half of first-time buyers use either a gift or a loan from family or friends to fund their down payment.

The financial decision to buy or rent in 2024 won't be one to take lightly. Those on the fence will need to answer some probing questions about their own savings and investment prowess, expectations for the market and how long they want to stay in one spot.

Inventory improves

Inventory continues to make slogging progress out of its pandemic hole. Inventory made its first annual gains since April, and levels are now 36% below pre-pandemic averages, an improvement over the 46% deficit seen in May.

The flow of new listings to the market is slightly better than a year before, and although levels are 14.5% below pre-pandemic norms, they seem to be trending in the right direction. Time will tell if that progress continues in 2024.

Competition continues

A lack of choices means buyers are unlikely to find price cuts, and they should expect competition for the most attractive listings. Price cuts are never popular in the winter, and this December, the share of listings with a price cut was just under 16% — the lowest since April 2022.

Although the market has cooled from the demand-fueled peaks of 2021 and 2022, listings are still going under contract in about a month — 50% faster than pre-pandemic norms. The latest Zillow data shows that nearly 30% of homes nationwide are selling for more than their original list price, compared to about 20% in 2018 and 2019.

Metropolitan | December | ZHVI | ZHVI | Median | Share of | New | Total |

United States | $344,000 | 3.2 % | -0.6 % | 30 | 15.6 % | -14.5 % | -36.0 % |

New York, NY | $632,700 | 5.1 % | 0.2 % | 39 | 8.0 % | -37.3 % | -52.5 % |

Los Angeles,CA | $906,427 | 6.3 % | -0.4 % | 22 | 11.6 % | -25.3 % | -42.6 % |

Chicago, IL | $302,038 | 5.9 % | -0.7 % | 22 | 15.5 % | -12.6 % | -50.4 % |

Dallas, TX | $363,613 | -0.5 % | -0.7 % | 34 | 20.3 % | -11.0 % | -21.3 % |

Houston, TX | $298,897 | -0.4 % | -0.6 % | 39 | 17.3 % | -9.3 % | -20.1 % |

Washington, DC | $539,996 | 3.6 % | -0.3 % | 17 | 15.4 % | -26.2 % | -46.7 % |

Philadelphia, PA | $343,986 | 6.8 % | -0.4 % | 17 | 16.7 % | -16.5 % | -49.0 % |

Miami, FL | $475,927 | 6.7 % | 0.1 % | 37 | 16.4 % | -6.4 % | -29.1 % |

Atlanta, GA | $371,691 | 3.3 % | -0.4 % | 33 | 17.6 % | -22.7 % | -29.1 % |

Boston, MA | $654,752 | 7.5 % | -0.5 % | 15 | 9.8 % | -15.5 % | -46.4 % |

Phoenix, AZ | $445,772 | 1.4 % | -0.5 % | 41 | 19.7 % | -23.8 % | -22.2 % |

San Francisco, CA | $1,097,441 | 0.6 % | -1.0 % | 32 | 9.6 % | -25.2 % | -17.7 % |

Riverside, CA | $561,697 | 4.0 % | 0.0 % | 29 | 14.2 % | -23.8 % | -41.3 % |

Detroit, MI | $236,823 | 5.2 % | -1.0 % | 21 | 16.9 % | -14.7 % | -38.0 % |

Seattle, WA | $698,469 | 1.9 % | -0.5 % | 27 | 14.6 % | -32.5 % | -35.6 % |

Minneapolis, MN | $357,009 | 1.4 % | -1.1 % | 40 | 15.2 % | -16.4 % | -35.9 % |

San Diego, CA | $900,045 | 8.4 % | -0.2 % | 22 | 15.3 % | -31.3 % | -51.6 % |

Tampa, FL | $374,283 | 2.2 % | -0.3 % | 33 | 23.3 % | -14.6 % | -13.0 % |

Denver, CO | $567,674 | 0.6 % | -0.6 % | 34 | 16.5 % | -32.5 % | -21.9 % |

Baltimore, MD | $368,426 | 4.0 % | -0.6 % | 17 | 19.0 % | -10.5 % | -51.6 % |

St. Louis, MO | $238,853 | 5.3 % | -0.7 % | 16 | 16.9 % | -14.8 % | -49.8 % |

Orlando, FL | $386,525 | 3.0 % | -0.3 % | 29 | 20.2 % | -4.2 % | -10.2 % |

Charlotte, NC | $368,501 | 2.8 % | -0.5 % | 26 | 15.4 % | -10.3 % | -12.2 % |

San Antonio, TX | $280,461 | -3.3 % | -1.0 % | 49 | 20.3 % | -0.9 % | 7.6 % |

Portland, OR | $529,358 | 1.0 % | -0.7 % | 36 | 15.5 % | -28.4 % | -26.5 % |

Sacramento, CA | $556,932 | 1.1 % | -0.6 % | 24 | 14.8 % | -33.7 % | -41.2 % |

Pittsburgh, PA | $202,560 | 4.3 % | -1.0 % | 26 | 16.9 % | -6.4 % | -41.6 % |

Cincinnati, OH | $268,481 | 5.3 % | -0.7 % | 15 | 17.1 % | -6.9 % | -38.6 % |

Austin, TX | $450,888 | -7.2 % | -1.0 % | 68 | 17.1 % | -16.5 % | 26.1 % |

Las Vegas, NV | $408,719 | 1.5 % | 0.1 % | 32 | 16.8 % | -34.2 % | -38.4 % |

Kansas City, MO | $287,709 | 4.8 % | -0.8 % | 16 | 18.4 % | -15.5 % | -45.2 % |

Columbus, OH | $297,299 | 5.3 % | -0.8 % | 16 | 20.0 % | -9.2 % | -34.1 % |

Indianapolis, IN | $266,000 | 2.0 % | -0.8 % | 28 | 21.8 % | -6.2 % | -21.7 % |

Cleveland, OH | $213,138 | 6.2 % | -0.8 % | 16 | 18.7 % | -15.7 % | -53.7 % |

San Jose, CA | $1,472,791 | 6.5 % | -0.4 % | 19 | 10.2 % | -9.9 % | -36.6 % |

Nashville, TN | $426,745 | 0.3 % | -0.6 % | 35 | 19.8 % | -21.6 % | -25.9 % |

Virginia Beach, VA | $333,766 | 5.6 % | -0.3 % | 33 | 18.4 % | -13.0 % | -52.1 % |

Providence, RI | $453,543 | 7.9 % | -0.4 % | 20 | 13.8 % | -32.4 % | -65.0 % |

Jacksonville, FL | $352,076 | -0.5 % | -0.4 % | 43 | 19.9 % | -0.1 % | -16.3 % |

Milwaukee, WI | $320,624 | 7.9 % | -1.1 % | 33 | 14.3 % | -5.5 % | -29.2 % |

Oklahoma City, OK | $225,239 | 3.2 % | -0.4 % | 29 | 19.4 % | 8.2 % | -13.5 % |

Raleigh, NC | $430,048 | 1.3 % | -0.6 % | 28 | 19.5 % | -17.4 % | -24.5 % |

Memphis, TN | $231,380 | -0.2 % | -0.5 % | 35 | 18.6 % | -19.7 % | -7.0 % |

Richmond, VA | $350,497 | 4.8 % | -0.2 % | 14 | 16.6 % | -16.8 % | -53.5 % |

Louisville, KY | $244,786 | 4.2 % | -0.6 % | 18 | 20.4 % | -11.4 % | -36.6 % |

New Orleans, LA | $234,383 | -8.1 % | -1.1 % | 46 | 15.0 % | 32.0 % | 41.8 % |

Salt Lake City, UT | $524,982 | 0.6 % | -0.7 % | 35 | 20.8 % | -23.2 % | -16.1 % |

Hartford, CT | $337,533 | 11.7 % | -0.3 % | 9 | 12.8 % | -5.2 % | -69.6 % |

Buffalo, NY | $243,750 | 6.2 % | -1.1 % | 18 | 12.5 % | -22.1 % | -49.2 % |

Birmingham, AL | $245,269 | 0.7 % | -0.9 % | 28 | 15.2 % | 8.5 % | -22.9 % |

*Table ordered by market size

1 The Zillow® Real Estate Market Report is a monthly overview of the national and local real estate markets. The reports are compiled by Zillow Research. For more information, visit www.zillow.com/research.

2 Definitions of affordability vary, and what's affordable varies by household. Housing payments taking more than 30% of median household income have been noted by Zillow as a housing burden, leaving less money available for other necessities. Another common measure of affordability is for housing costs to require less than one-third of a household's income.

About Zillow Group:

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, great partners, and easier buying, selling, financing and renting experiences.

Zillow Group's affiliates, subsidiaries and brands include Zillow®, Zillow Premier Agent®, Zillow Home Loans℠, Trulia®, Out East®, StreetEasy®, HotPads®, ShowingTime+℠, Spruce® and Follow Up Boss®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2023 MFTB Holdco, Inc., a Zillow affiliate.

(ZFIN)

SOURCE Zillow

For further information: Mark Stayton, Zillow, press@zillow.com