Press releases

Expert panel expects home prices will grow at a steady pace starting in 2024

Mar 2, 2023

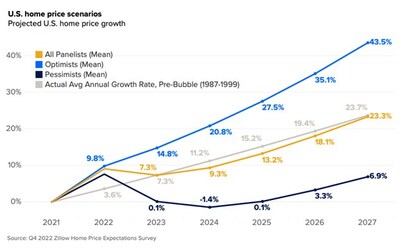

Economists surveyed by Zillow predict home-price slide will end this year

- The panel forecasts prices to slide 1.6% in 2023; growth over the following four years is expected to average 3.5%, equivalent to the long-term average.

- New home sales are expected to decline to near 2016 levels this year.

- Sales of both new and existing single-family homes are expected to slide in 2023.

SEATTLE, March 2, 2023 /PRNewswire/ -- Home prices nationally should bottom out in 2023 then return to a more normal growth rate, according to a Zillow® survey of housing experts.

Economists and housing experts polled in the latest Zillow Home Price Expectation (ZHPE) survey expect home prices to fall 1.6% through Dec. 2023. Affordability challenges are still dragging down demand for homes – lower mortgage costs in January translated into sales that tracked pre-pandemic trends, but higher rates in February have since dampened buyers' enthusiasm.

Starting next year, however, the panel foresees price growth picking back up, at an average clip of 3.5% per year through 2027 – the same rate that prices grew in the relatively stable period from 1987-1999, before the housing boom and bust cycle in the 2000s.

Zillow's latest in-house forecast calls for typical U.S. home values to be nearly flat, rising 0.2% over the course of 2023. The largest declines are forecast in expensive California metros.

"The housing market is resetting. Though we're seeing early signs of renewed buyer interest early this year, prices should generally flatten out in 2023, helping buyers to catch up," said Zillow senior economist Jeff Tucker. "The sheer number of people in the first-time homebuyer age range and a lack of inventory should limit price declines. A return to more normal growth would be welcome after the rollercoaster ride that home prices have been on lately."

Sales of existing homes are forecast to fall to 4.2 million in 2023 – up slightly from November and December's seasonally adjusted annual rate of sales, but lower than 5.0 million sales in the course of calendar year 2022.

New construction – also expected to see sales decline this year – will likely play an expanded role to meet the need for inventory, said Tucker. Existing homeowners have been reluctant to list their properties and builders are giving buyers some significant financial incentives to help overcome affordability constraints.

The panel also expects mortgage rates to trend downward after the first quarter. Asked when rates for 30-year fixed loans will be highest between now and 2025, nearly two thirds (63%) pointed to Q1 of 2023. A distant second was the second quarter of 2023 at 22%, and subsequent quarters earned 6% or less. Falling rates are far more helpful for affordability than falling home prices, at least at the scale of recent movements. The median respondent projected a 6% rate for 30-year fixed-rate mortgages at the end of 2023.

"The majority of experts are now predicting an outright decline in U.S. home prices in 2023," said Terry Loebs, founder of Pulsenomics. "Although mortgage rates have moderated and are expected to remain close to the 6% level at year-end, the 2022 rate spike – and the record-high mortgage costs it ushered in – continues to shake home price expectations and market psychology."

1 | This edition of the Zillow Home Price Expectations Survey surveyed 117 housing market experts and economists Dec 5th-Dec 15th, 2022. The survey was conducted by Pulsenomics LLC on behalf of Zillow, Inc. The Zillow Home Price Expectations Survey and any related materials are available through Zillow and Pulsenomics. |

2 | This question was posed to the panel using the previous version of the Zillow Home Price Index. The new version of the ZHVI built off the neural Zestimate was implemented in February 2023. See this methodology note for an explanation of the differences in metrics. |

About Zillow Group

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make it easier to unlock life's next chapter. As the most visited real estate website in the United States, Zillow® and its affiliates offer customers an on-demand experience for selling, buying, renting, or financing with transparency and ease.

Zillow Group's affiliates, brands and subsidiaries include Zillow®; Zillow Premier Agent®; Zillow Home Loans™; Zillow Closing Services™; Trulia®; Out East®; StreetEasy®; HotPads®; and ShowingTime+℠ , which houses ShowingTime®, Bridge Interactive®, and dotloop® and interactive floor plans. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org).

About Pulsenomics

Pulsenomics LLC (www.pulsenomics.com) is an independent research firm that specializes in data analytics, opinion research, new product and index development for institutional clients in the financial and real estate arenas. Pulsenomics also designs and manages expert surveys and consumer polls to identify trends and expectations that are relevant to effective business management and monitoring economic health. Pulsenomics LLC is the author of The Home Price Expectations Survey™, The U.S. Housing Confidence Survey, The Housing Confidence Index, and The Transaction Sentiment Index. Pulsenomics®, The Housing Confidence Index™, The Transaction Sentiment Index™, and The Housing Confidence Survey™ are trademarks of Pulsenomics LLC.

SOURCE Zillow

For further information: Mark Stayton, Zillow, press@zillow.com