Press releases

Getting a Mortgage No Easier Than a Year Ago

The thaw in mortgage access paused in the first quarter of 2015, according to the Zillow Mortgage Access Index.

Sep 1, 2015

SEATTLE, Sept. 1, 2015 /PRNewswire/ -- Access to mortgage credit tightened in the first quarter of 2015, according to the Zillow® Mortgage Access Index (ZMAI). It had been getting progressively easier to obtain a mortgage since 2012, but the first several months of this year marked a pause in easing access to mortgage credit.

Mortgage credit availability is almost unchanged from a year ago, meaning despite fluctuations from quarter-to-quarter, there has been little progress toward making mortgages easier to obtain over the last year. In the long-term, experts expect mortgage access to continue improving.

In a survey earlier this summer of more than 100 economists and housing experts, more than 60 percent said they expect mortgage regulations to loosen further, with many expressing concern the market will become too lax over the next year.i

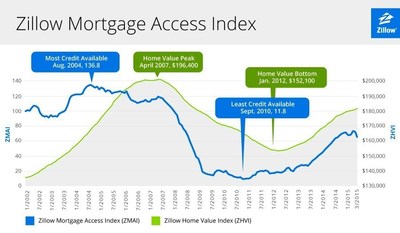

A high number in the Zillow Mortgage Access Index means credit is easier to obtain, while a lower number means credit is tighter.

Mortgage credit was easiest to obtain in July 2004, when the ZMAI reached 136.4. But availability tightened over the next few years. In May 2007, both the housing and mortgage availability began a multi-year plunge, leaving home values down more than 22 percent and credit the tightest in recent history. Mortgages were the toughest to obtain in September 2010, when the ZMAI was at 11.8.

Today, access to mortgage credit has improved significantly, and is at 65, more than two thirds of the way back to 2002 pre-crisis levels.

"Recent market volatility is causing some lenders to be more cautious in their underwriting," said Zillow Chief Economist Dr. Svenja Gudell. "Tighter mortgage access will make it harder for people with low credit scores to get a home loan, and even people who can get approved for a mortgage will have fewer options in terms of available mortgage products."

The ZMAI uses seven variables to measure access to credit. Of those variables, the bottom 10th percentile of credit scores accepted, the prevalence of second mortgages, and the number of quotes on Zillow offered to mortgage inquirers saw the greatest positive movement in the six most recent months of ZMAI.

Variables used in the Zillow Mortgage Access Index

- Credit Score: The lowest 10th percentile of credit scores to reveal which borrowers were on the cusp of denial in the period. Lower credit score approval indicates mortgage credit loosening.

- Debt-to-income ratio: The 90th percentile of borrower debt-to-income (total monthly debt payments as a percent of gross monthly income). An increase in debt-to-income ratios suggests mortgage credit is loosening.

- Private Mortgage Insurance: The proportion of low down payment loans that are privately insured. Since FHA loans cater to lower credit scores but often come with higher costs, an increase in privately insured mortgages would indicate mortgage credit is loosening.

- Second Mortgage Prevalence: Home equity loans and lines of credit as a percent of all loans in a given period. An increase in second mortgages suggests mortgage credit is loosening.

- Non-conforming Loans: Amongst loans with down-payments over 20%, the percentage that are non-conforming. An increase in non-conforming loans signals lenders are willing to take on additional risk and therefore would indicate mortgage credit is loosening.

- Mortgage Rate Spread: The spread between 30-year fixed mortgage rates and the 10-year treasury rates. A narrowing spread suggests mortgage credit is loosening.

- Zillow Mortgage Quotes: Tracks the monthly average number of quotes given to borrowers with credit scores between 600-640 compared to the number given to borrowers with credit scores of 760 or higher. The closer the two numbers are, the easier mortgage credit is to obtain.

The Zillow Mortgage Access Index is a quarterly report. Data on the individual variables used to calculate the Index will be available on Zillow Real Estate Research.

About Zillow

Zillow® is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with the best local professionals who can help. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow's Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Zillow also sponsors the bi-annual Zillow Housing Confidence Index (ZHCI) which measures consumer confidence in local housing markets, both currently and over time. Launched in 2006, Zillow is owned and operated by Zillow Group (NASDAQ: Z and ZG), and headquartered in Seattle.

Zillow is a registered trademark of Zillow, Inc.

i This edition of the Zillow Home Price Expectations Survey surveyed 111 experts between April 23rd and May 7th. The survey was conducted by Pulsenomics LLC on behalf of Zillow, Inc. For more information: http://zillow.mediaroom.com/2015-05-12-Experts-Easier-to-Get-Mortgages-May-Not-Draw-More-Buyers

Photo - http://photos.prnewswire.com/prnh/20150901/262645-INFO

SOURCE Zillow

For further information: Alison Paoli, Zillow, 206-757-2701 or press@zillow.com